Consumer protection regulations aim to prevent predatory lending, housing discrimination, securities fraud, privacy violations and other unethical business practices. They also push businesses to guarantee the quality of their products and services.

Warranties are one example of how consumers can be protected from manufacturers who produce unsafe products. But these protections aren’t foolproof.

What are my rights as a consumer?

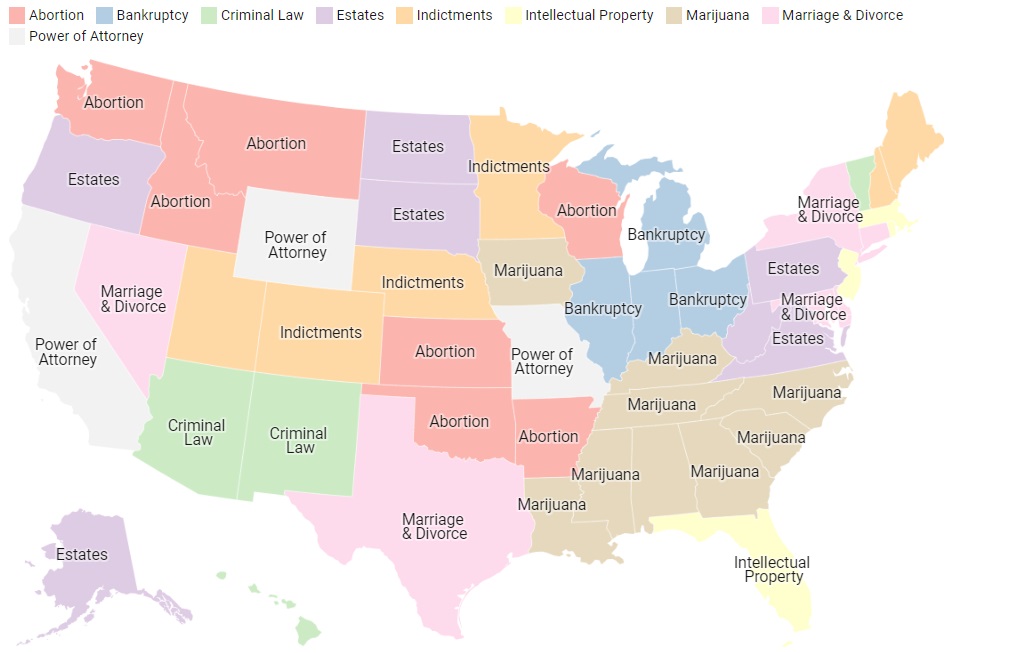

As a consumer, you have certain rights when you purchase goods or services. These rights protect you from being scammed or misled by businesses and help ensure that your transaction is fair. Consumer protection laws are made up of a large patchwork of state and Federal regulations covering everything from products like cosmetics and medicine to services such as lending practices and credit card terms.

Your basic rights include the right to safe, adequate and timely information about the product or service you are buying. This includes a requirement that businesses tell you about any potential hazards, side effects or risks associated with the product or service, as well as how it should be used. You also have the right to a variety of different products and services at competitive prices, and to be heard when your interests or complaints are brought to the attention of business managers or government officials.

In addition to your rights to safe, adequate and timely information about the goods and services you buy, you are entitled to be protected against unfair business practices and fraud by manufacturers and retailers. You can find out more about this by contacting your state’s attorney general or visiting the website of a consumer protection agency in your area.

When you purchase goods, services or digital content, you are entering into a contract with the seller. These contracts can be written or verbal, and they may set out certain terms that you must agree to (for example, the price of a good or how it is delivered). However, any terms that go against your consumer rights are not valid.

You have a legal right to return any faulty goods that you bought within 30 days. This applies to goods that you purchased in shops and online, as well as second-hand goods and digital content like computer games or music downloads. However, you must take care not to misuse or abuse your rights. If you do this, you could end up being banned from using your consumer rights in the future or being prosecuted by the authorities.

How can I protect myself from fraud?

The New Year is often a time for making resolutions, including setting goals to improve health and finances. But there’s a new to-do item you should add to that list: brushing up on how to protect yourself from fraud. Consumer protection laws are a large patchwork of Federal and state regulations covering everything from products like cosmetics and medicines to services such as lending practices, privacy violations, home ownership discrimination, environmental claims, and securities fraud. While the common law doctrine of caveat emptor (let the buyer beware) has always been the standard for protecting purchasers from false advertising and deceptive sales, these laws help provide additional safeguards.

In addition, it’s important to learn how to recognize scams and phishing attempts, to be vigilant about sharing personal information online, and to check out the Better Business Bureau before using any service.

What should I do if I have a problem with a product or service?

Consumer protection laws protect consumers from faulty or dangerous products, unethical business practices and other unfair trading activities. Consumers can use the law to claim remedies for problems with goods and services, such as refunds, repairs, compensation, and cancellation of contracts.

The first step is to contact the business and explain your problem and what outcome you want. It’s best to do this as soon as possible. You can phone or web chat, or write a letter. CHOICE has helpful email and telephone scripts to help you do this.

If the business agrees that your product or service doesn’t meet basic rights known as consumer guarantees, it must offer you a solution. Depending on the problem and what you bought, this could involve a free repair, replacement, refund or cancelling a contract. You may also be entitled to compensation for any damage or loss you suffered as a result of the problem.

If the business won’t do what you ask, contact your local consumer protection office or a national consumer organization. These organizations can mediate disputes and investigate companies that break consumer protection laws. They can also advise you on what legal options are available if the problem persists. Consumer Ed is a free online resource that answers frequently asked questions about consumer protection issues such as warranties, debt collection, credit reports and credit cards. It’s written by lawyers and not-for-profit consumer organizations.

What should I do if I’ve been ripped off?

If you have been ripped off, don’t just sit by and allow the merchant to get away with it. Call the consumer protection agency for your state or the Federal Trade Commission, and report the offending business to them. This will result in the business being investigated and may cause them to change their business practices for the better. If that doesn’t work, you may want to consider filing a civil lawsuit against the business. Civil cases have much lower burdens of proof than criminal cases, and you could recover your actual losses plus damages such as attorneys fees and emotional distress. You can also file a complaint with the police. (But the decision whether to press charges is made by the prosecutor, not you). The Texas Deceptive Trade Practices Consumer Protection Act provides a wide range of remedies for consumers who are ripped off in advertising, auto buying and repair, food shopping, mail order, etc.